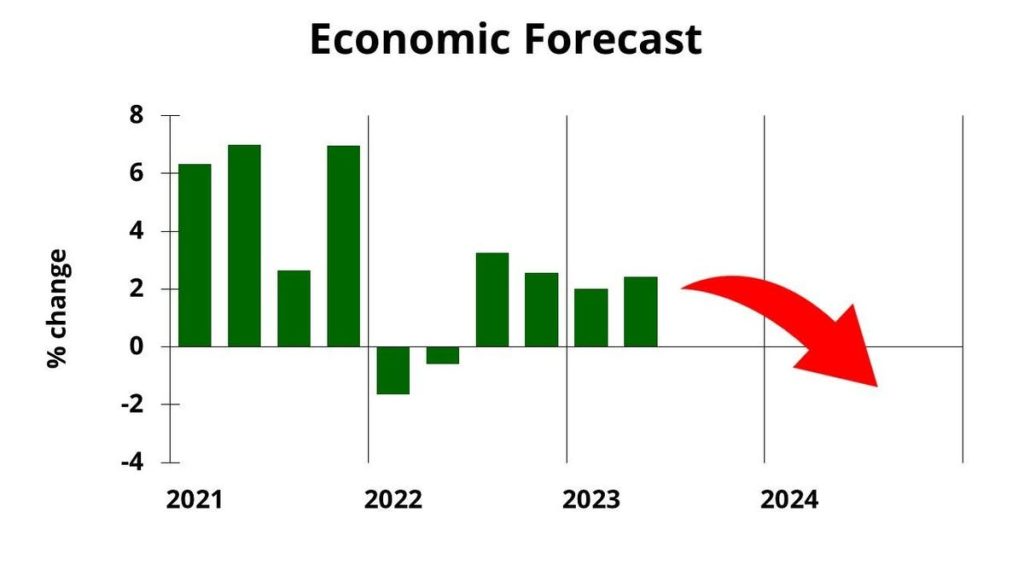

Economic growth was decent in the second quarter at 2.0%, but that does not mean we’re out of trouble. The contractionary pressures remain, and the delaying factors are dwindling. The downturn will be mild, as recessions go, but a recession nonetheless.

Typical Business Cycle

Following the advice of forecasting expert Philip Tetlock, I begin with a typical business cycle driven by the Fed’s tightening. Of course no cycle is really average, so after looking at the typical cycle we must consider how this one will differ in timing and magnitude. But that baseline typical recession is crucial to avoid getting too caught up in the most recent data.

If the Federal Reserve does not raise interest rate further, the economy will lose about one percent of gross domestic product over the next five quarters, assuming a typical cycle. That would be much milder than the average recession but longer than average. Now let’s look at how this cycle is likely different from average.

Last year I identified factors that could make the time lag before recession shorter or longer. On the shorter side, the Fed communicated its intent to tighten before it began, contrary to the historical experience. Also shortening the time lag would be global monetary tightening rather than the U.S. acting alone. That continues to be the case in North America and Europe, but not Asia.

Delaying the Recession

The longer time lag factors are also still in place. Automobile sales usually tumble when interest rates rise, but supply chain problems in that sector caused pent-up demand which is now being filled. So the auto industry has not yet dropped as much as it typically would. Last month’s sales were significantly above the 2022 monthly average, but sales and production will eventually come down.

Business capital spending usually cools as well, but second quarter growth rebounded from previous weakness, up 10.8% (annualized). Companies want to use computers, equipment and machinery to make up for employees they cannot hire, and they are also building new factories to shorten their supply chains. We may skip a downturn in this sector.

The tight labor market also delays the usual business cycle. The weakness in parts of the economy leads to layoffs, but many displaced workers have simply walked across the street to be hired by another company. Despite the sharp interest rates hikes that began well over a year ago, employment has increased every month.

A fourth delaying factor is that consumers are still spending some of those stimulus payments they received in 2020 and 2021. Data on consumer income and spending suggest that excess savings—in excess of the normal savings trend—peaked at $2.3 trillion in the summer of 2021, with about one-third of that still remaining in household bank balances. That cushion is especially helpful to those who have lost their jobs. The current rate of spending can continue through about April 2024.

One additional issue was not anticipated (at least by me): home buyers purchasing new houses. Higher mortgage rates typically slow home sales, so builders cut back on their new construction. But after the record low mortgage rates, people are hesitant to sell their existing homes. They may want more space, fresher amenities or nicer neighborhoods, but they won’t walk away from a three percent mortgage when a new one will cost seven. So home-buyers turn to new construction. Yes, they pay a high mortgage rate, but their parents and grandparents tell them it’s not so bad. And they expect to refinance in a few years. So single family residential construction is holding up quite well.

Soft Landing Possible But Unlikely

Could the delaying factors ease the economy into a soft landing? That looks more plausible than ever before, but forecasting “this time it’s different” usually turns out badly. Higher borrowing costs will delay consumer and business spending on big-ticket items, which will lead to recession. Banks are tightening their credit standards and increasing their loan pricing over deposit costs, according to the Fed’s latest Senior Loan Officer Opinion Survey.

My judgment call remains that the recession will begin in the first half of 2024, or possibly late in 2023. Memories of the 2008-09 recession are unfortunate because this one will certainly be much milder. Most families and businesses will feel it in news headlines rather than their own experience. But the more cyclical parts of the economy will have to face a downturn.

Inflation Falls Eventually

Inflation will come down to the Fed’s two percent target, but not until 2025. By the time the recession begins, however, Fed officials will be confident they are on the right path and will likely hold interest rates level through most of 2024.

A business cannot hunker down in fear of recession forever, but the Fed’s sharp tightening and their commitment to bring inflation down must have consequences. Recession is one of those consequences.

Read the full article here