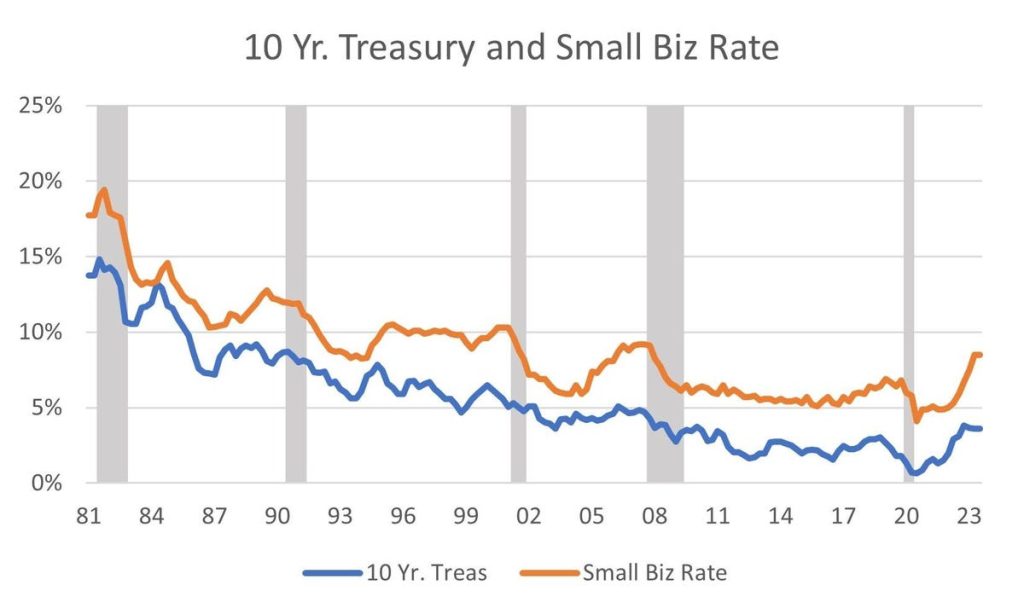

The Federal Reserve has raised its policy rate at the fastest pace since Volcker in the 1980s in his inflation fight. From near 0% a little over a year ago, the policy rate is now near 6%. A nice side effect of this policy is that people with savings accounts are finally earning a decent return (nominal, not inflation adjusted). But loan rates for small businesses have risen substantially, from a low of 4% to over 8%, making credit much more expensive (Chart 1). For small firms, the cost of credit is not the major concern, rather it’s the availability of credit needed to keep the business functioning financially. Cash flows are critical to successful operations. Note that in 1980, firms paid an average loan rate of 19% (in an inflationary environment of double-digit price hikes).

Since 1981, NFIB has asked a random sample of its 300,000 (approx.) member firms to report their credit market experiences, including the rate of interest paid on their most recent loan. Chart 1 documents the close relationship between the rate of interest the government paid to borrow money and the average rate paid by small firms. When the Fed raises its policy rate, the costs of all forms of credit rise, simply because lenders (like banks) must pay more to get funds from depositors and investors to lend out. Mortgage rates are usually indexed to the 10 Year Treasury bond.

Asked about whether the last loan was “easier or harder” to get than their prior loan, 8% said “harder,” and no respondents said “easier” (not seasonally adjusted). This compares to 16% “harder” and 0% “easier” in October 2008 and 31% “harder” in April 1980 as Chair Volcker accelerated his fight against inflation. So far, in comparison, credit markets have remained very friendly since the Fed initiated its latest interest rate increases. The Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices indicates that banks are definitely tightening their credit criteria, at both large and small banks.

Beginning in 1993, owners were asked if all their credit needs had been met. A series low net 16% reported “yes” in October 2010, 27% “yes” and 11% “no.” In July of 2020, 35% reported “yes” and only 3% reported “no.” The economy was doing very well then, inflation under 2% and record low unemployment rates. Most recently, 25% reported “yes” and 3% said “no,” a friendly but not exuberant reception. But credit conditions have not become severely restrictive – yet.

The Fed is not likely to take rates much higher, sparing us a 1980s or 2008 set-back. But leaving rates high will continue to put a downward pressure on the economy. It takes time for high rates to depress spending and investment, and they will continue work to suppress spending even with no further rate hikes. Fiscal policy will remain stimulative for some time unless Congress agrees to cut it back, making the inflation fight more difficult as government spending supports prices. The cost of living is up dramatically over the last year, and unless wages increase as fast (and they have not), real earnings are falling and this will ultimately slow spending and reduce prices, eventually ending “inflation” as a serious problem.

Read the full article here